Allah will abolish interest and will cause charity to increase. And Allah loves not anyone who is a confirmed disbeliever and an arch-sinner.—The Holy Quran, 2:266

*

Nay, but you honour not the orphan, and you urge not one another to feed the poor, and you devour the heritage of the poor, and you love wealth with extreme love. —The Holy Quran, 89:18–21

*

Chapter Four

The Islamic economic order neither belongs to capitalism nor to scientific socialism. The economic philosophy of Islam is scientific without being mechanical. It is disciplined without being over-restrictive. It allows private possession and private enterprise but does not promote greed and the amassing of wealth in a few hands whereby a large section of society turns into destitute, serfs and slaves to a cruel and relentless system of exploitation.

There are three fundamental differences in the economic philosophies of capitalism, communism and Islam.

In capitalism, capital is rewarded with interest. It is intrinsically accepted in principle that capital has a right to grow. Interest plays the central motive force for the amassing of capital, which is then channelled as energy to set and keep the assembly line of production in motion. In short, interest acts as an incentive for keeping capital in circulation.

In scientific socialism, although there is no incentive of interest to cycle and recycle capital into a productive mechanism, the state monopolises capital. So, there is no need for motivation.

In free private enterprise, whether one pays or does not have to pay interest, one’s sense of personal ownership is sufficient to create an urge that one’s capital should grow at the fastest possible rate. If one has to pay interest on borrowed money, the rate of interest acts as a benchmark. It works like a window through which one can monitor the comparative growth or diminution of capital. In the socialist economic system, however, there is neither this urge, because those who employ capital do not own it, nor is there any means of comparison whereby one can judge whether the rate of growth is economically sufficient or not.

In socialist scientific order, the forcible possession of the entire state’s capital by the state itself renders the system of interest totally irrelevant and meaningless. The snag is that when you are not under any pressure to earn more than the interest you may have to pay, you lose all incentives and any sense of responsibility.

If the entire capital in circulation in a communist state could, for instance, be valued from the point of view of how much interest it could earn had it been deposited in a bank, that would present us with one side of the picture. The second side of the picture could be conceived by assessing the economy on a profit and loss basis. Of course, it would present many complications such as assessing wages etc. But if financial experts put their heads to it, such hurdles may be overcome. A comparison of these two would present very interesting possibilities.

It is more than likely that the real culprits for the decline of standards of living could precisely be pinpointed in this way. Even without such a gigantic exercise, it is not difficult at all for one to determine the causes of such decline. I believe that because the state becomes the capitalist, it is deprived of a monitoring system to warn it of failures, wastage and blunders regarding the way it handles the state’s capital because it has no financial obligations to fulfil and can employ capital without accountability. Such a situation is rife with inherent dangers. Lack of personal interest and a warning system on the profit or loss arising from the employment of capital works havoc with the input-output ratio. The quantum of waste goes on increasing.

Again, there is no check placed on the policy of channelling capital. For instance, there is no mirror for the socialist governments to judge the real rate of economic growth in comparison to the free market economies of the outside world. An added problem is that communist states require much larger expenditure on defence, surveillance and law-enforcing agencies within the country. Other things being equal, this requires a disproportionate level of expenditure on defence and the maintenance of law and order. These and other similar factors take a heavy toll on the economy. The ultimate collapse of the economy can be delayed, of course, but cannot be averted altogether.

While communism provides no incentive for direct dedicated involvement in the production of wealth, despite banishing interest, Islam provides the incentive. Islam does away with the system of usury and interest without sharing the specific problems of the communist world. In the absence of interest dragging capital along non-productive channels, Islam checks idle capital. This check is a form of ‘tax’ known as Zakat, which is levied not on income or profit but on the capital itself.

The contrast is very clear. In capitalist societies, capital is amassed in the hands of a few out of greed to increase capital through the accumulation of interest and is recycled into the economy with the set task of yielding a profit greater than the prevailing rate of interest. Failing this, the economy is bound to go into recession. In Islam, out of fear that any idle capital would be gradually eroded away through the imposition of Zakat, anyone with surplus savings would have to employ it in earning profit to offset the effect of Zakat.

According to Islam, the answer to the economic problems of the world lies neither in scientific socialism nor capitalism. It is impossible to elaborate on this subject here but we must have a topical view of the economic imbalance created by capitalism to draw some lessons for the future.

The signposts for determining that such an imbalance has arisen in a society are very clearly stated in the following verses of the Holy Quran:

Nay, but you honour not the orphan. And you urge not one another to feed the poor. And you devour the heritage of the other people wholly. And you love wealth with exceeding love.1

Briefly, these features are:

Usurpation of the heritage of others.

Without endorsing the philosophy of scientific socialism, Islam rejects some aspects of capitalism because:

Mutual rivalry in seeking worldly increase diverts you from God. Till you reach the graves. Nay! you will soon come to know the truth.2

Exploitation of poorer citizens by interest-based capitalism, which gives birth to socialist rebellion, seems to be relegated to history. But a deeper study would reveal that it is only a change of guise.

Already the world as a whole has been split into the haves and have-nots, thanks mainly to the exploitation by the advanced capitalist countries. Add to this situation the momentous return to capitalism by the repentant Eastern bloc. One shudders to visualise how much more blood would be sucked from the already enfeebled and anaemic nations of the Third World. But, it would seem that the vampires of capitalism must draw more blood.

It is clear that the age of confrontation between the two major opposing economic philosophies of capitalism and scientific socialism is over. The economic systems based on Marxism-Leninism have bowed out of the stage of human affairs. On the other hand, the so-called ‘free’ economy of the West seems to be exultant over its apparent victory. Barring China, the Eastern bloc countries are still struggling to mitigate the miseries of the multitudes of have-nots in their respective countries in the wake of their newfound freedom.

The economic gap between the East and West is not as big as that between the North and South. The First World countries of the North are divided on another plane from the Third World countries of Africa and South America. Though in terms of economic disparity, the gap between North and South America is certainly hurtful, it is nowhere near the gap between Europe and Africa. Africa, so close in proximity to Europe is, in terms of economic disparity, the farthest apart from Europe.

The sense of security that was once enjoyed by the weaker countries of the world because of the rivalries between the super-powers and any chance of the poorer nations benefiting from the thawing of the cold war will fast fade out. There is going to be much greater and more earnest competition between the USA, Russia and the rest of Europe to win, monopolise and secure the markets of the Third World countries.

Japan will no longer be the only serious rival to America. A new Europe emerging out of the rapid growth of the European Community and the prospective participation of Eastern Europe in a larger common market will pose a far more formidable competition to America than the rival states of Europe.

The teeming millions of East Europe and Russia are looking forward to and stand in dire need of raising their living standards. Merely the rehabilitation of a closed market would not be sufficient to meet this tall order, which is likely to grow taller with the passage of time. The dire necessity of external markets to support the rising living standards in East Europe and Russia may be met by the E.C., America and Japan. It offers little hope for the Third World countries—a bleak picture indeed for the Third World—much more so for the less fortunate people of Africa.

The politicians of the economically and politically advanced nations of the world are far more concerned by the capitalist economic revolution taking place in the Far East—Japan, South Korea, Formosa, Hong Kong and Singapore. It seems that the distance between the Far East and the West is being bridged over the heads of many less fortunate Asian countries Indonesia, Malaysia, Cambodia, Thailand, Burma, Bangladesh, India, Sri Lanka and Pakistan.

It is also possible that to meet the growing challenge from the gigantic economy of Japan and to put a check on its rapidly expanding economy, other Far Eastern countries would no longer remain beneficiaries of American know-how and capital. On the other hand, it is also possible that America may lean even more on its Far Eastern allies to meet new combined challenges from Japan and an economically much bigger and united Europe. This augurs ill for the future of mankind and may ultimately shatter the prospects for peace on a completely different plane than the ideological rivalries between capitalism and communism.

It is too early to predict how the changes in Eastern Europe and Russia may influence the economic balance of the world and whether their return to capitalism may be complete or partial or slow or rapid. Whatever happens, one thing is certain that these changes will further adversely influence the economies of the Third World. Such a state of affairs cannot last indefinitely. Already, the world is heading towards a global catastrophe.

Islam has a word of advice for the presently exultant capitalist countries built on a hollow foundation of usury and interest. They are ultimately bound to tumble down and shatter to pieces. The so-called recent victory by capitalism over socialism will only provide transient peace. Capitalist philosophies by themselves will give birth to powerful demons which will rapidly grow to gigantic size in the absence of rivalries from socialism. The volcano of capitalism will finally erupt with such force that the whole world will shake, quake and convulse.

As with the social system advocated by Islam, the Islamic economic system commences with the premise that all that is in the heavens and the earth has been created by God, Who has bestowed man various provisions on trust. As a trustee, man will be held accountable for the discharge of this trust. The possession or absence of wealth is a means of trial so that in both abundance and adversity, those who are mindful of their accountability may be distinguished from those who resort to callousness and scant attention to the sufferings of the rest of mankind.

The Holy Quran repeatedly reminds us:

To Allah belongs the Kingdom of the heavens and the earth; and Allah has power over all things.3

Then it teaches that if everything has been created by God for all, some of it should be shared amongst men.

Have they a share in the Kingdom? Then would they not give men even so much as the little hollow in the back of a date stone?4

Allah has favoured some of you above others in worldly gifts. But those more favoured will not restore any part of their worldly gifts to those under their control, so that they may be equal sharers in them. Will they then deny the favour of Allah?5

Man’s responsibility is to discharge this trust honestly and equitably:

Verily, Allah commands you to give over the trusts to those entitled to them, and that, when you judge between men, you judge with justice. Surely excellent is that with which Allah admonishes you! Allah is All-Hearing, All-Seeing.6

The fact that material wealth is a source of trial is expressed in the Holy Quran as follows:

Verily, your wealth and your children are a trial; but with Allah is an immense reward.7

An important concept of possession under Islam is that certain resources are taken out of individual ownership and placed in the hands of mankind as a whole. Thus, mineral resources and the produce of seas and oceans is not the exclusive property of any individual or group of people.

Zakat is one of the five pillars of Islam—the others being the affirmation that there is no God but Allah and Muhammad(sa) is His Messenger; prayers; fasting during the month of Ramadan; and pilgrimage to the House of Allah in Mecca. For instance, the Holy Quran commands:

Observe prayer and pay the Zakat and obey the Messenger that you may be shown mercy.8

The Arabic word Zakat literally means to purify something and in the context of a mandatory levy would mean that the residual wealth after the deduction of Zakat had rendered it pure and lawful for the believers.

It is normally levied at 2.5% on disposable assets above specific thresholds, which have remained in the hands of owners beyond one year. Although much has been said about the rate or percentage of this ‘tax’, we find no reference to any fixed percentage in the Holy Quran. In this respect, I beg to differ with the dogmatic view of medieval scholars. I believe that the question of percentage remains flexible and should be determined according to the state of the economy in a particular country.

Zakat being a specific levy imposed upon capital beyond certain thresholds, it can only be utilised for certain categories of expenditure. These have been spelt out in the following verse of the Holy Quran:

Alms are only for the poor and the needy, and for those employed in connection with their collection and distribution, and for those whose hearts are to be comforted, and for the freeing of slaves, and for those burdened with debt, and for those striving in the cause of Allah, and for the wayfarers. This is an ordinance from Allah. Allah is All-Knowing, Wise.9

The treasury is charged the administration of this ordinance. In the early history of Islam, Hazrat Abu Bakr(ra) and Umar(ra), the first two caliphs, were renowned for personally ensuring the speedy disbursement of alms in what became known as the first welfare state. This system had been at work with great success for centuries during the Abbasid period.

As has already been explained, the motive force of interest is replaced by the driving force of Zakat. When we examine this system in operation, many differences between the Islamic economic order and other economic systems come to light. The features of a completely different economy begin to emerge.

No amount of idle money, irrespective of it being large or small, can survive for long without multiplying faster than the rate at which it is taxed. That is precisely how Zakat propels the economy in a truly Islamic state.

Imagine a situation where an individual with a small amount of capital is unable to directly participate in trade and there are no banks to credit him with interest on his deposit. Yet, if the deposit be sufficiently large to be taxable as Zakat, there are revenue collectors who knock at his door each year for a percentage of his capital, Zakat is not beyond a prescribed threshold. Such individuals have only two alternatives; either to personally employ their money profitably or to pool their resources to establish small or large enterprises.

This will promote joint ventures, partnerships, the forming of small companies or public shareholding in larger companies on a strict profit and loss basis. Such companies will owe nothing to any financial institution to which they have to repay debts with interest. Hypothetically, when you compare the lot of such companies with that of their counterparts in capitalist economies, they will be found facing on completely different platforms during periods of trial and crisis. In the case of trade and industry facing a recession in a capitalist economy, the slowdown in production because of dwindling demand can push them to the brink of liquidation. The interest they have to pay to service their debts will go on mounting relentlessly until it will no longer be possible for such companies to stay afloat.

On the other hand, if an economy is run on Islamic principles, a slowdown in business and trade opportunities will only send trade and industry into a state of hibernation. That is how nature ensures survival of the fittest at the time of extreme stresses and adversities. When the input of energy decreases, output has to be lowered lest energy should drop below the critical level necessary for survival. As there is no relentless pressure of debt servicing in an Islamic financial system, it can withstand far greater pressure and challenges during a recession.

The Islamic economic system runs on the total absence of the interest factor. Yet there is no historical nor current evidence to suggest that as a result of no interest, the demon of inflation went amok, and set the prices spiralling up beyond control. In the contemporary times, we have a very interesting opportunity to draw comparisons with regard to the influence of interest rates, or its absence, on inflation.

The government of China under Mao Tse Tsung’s era made many experiments with the economy. Some faltered. Some produced excellent results. But during the entire reign of Mao Tse Tsung, interest was not allowed to play any part, either domestically or internationally. Yet, throughout this period, there was no prominent increase in inflation. In fact, when ultimately the overall production level increased, prices began to register a fall.

As compared to this, in the State of Israel, perhaps the world’s most capitalist country, the rate of inflation has been amongst the highest recorded anywhere in the world, except, of course, in Latin American countries and the post-war exceptional phenomenon of inflation in Europe, particularly in Germany. But then those were not normal days. Other things being equal, the role of interest in any economy cannot be described as anything other than inflationary.

The current hot debate in Great Britain regarding the pros and cons of high interest rates offers an interesting example for study. For a long time now, the Conservative government has kept interest rates precariously high with the sole declared purpose to curb private consumption and thus suppress inflation. The economy is already squeaking and groaning under the stresses this policy has caused.

Many a lesson can be drawn from this study. Among other things, this study presents a fit case of highly potent economic decisions being taken on the basis of a theory, which in itself is debatable.

The notion that the higher the interest rate is raised the more will inflation be reduced seems to be the only reason to justify the maintenance of interest rates at an unnatural high level for so long.

In the case of our current study of what is happening in Great Britain, the rate of interest has never been the real culprit in the inflationary trend. There must have been mismanagement in many areas of the economy and an overall faulty economic policy, which resulted in the relative high inflation rate of the present time. The raising of interest rates has only served to distract the attention from the root causes to an easy scapegoat. This strategy may show a measure of success in combating inflation to begin with but it has already set in motion powerful factors, which would produce secondary effects. The country would be pushed to an unmanageable state of recession and unemployment would soar.

It is impossible to believe that advice from leading economists, experienced financial planners, central bankers and other experts is not available to the think-tank of the Conservative government. There has to be some reason for this prolonged wilful delay in lowering the high rate of interest on the hollow plea that it is essential for the survival of the national economy to push down the inflationary trend with the leverage of high interest rates. Could it be possible that the timing of lower interest rates is not politically suitable to the present government? Perhaps if it is delayed until close to the next general elections, the immediate relief felt by all sections of society from the cut in interest rates, could be turned to the political advantage of the Tories. If this is done too early on, the secondary effects to which I have already alluded may begin to manifest themselves and offset any gains from the temporary relief brought about by lower interest rates.

Some of the factors, which may unleash this undesirable phenomenon, are as follows:

1) The high rate of interest has not only choked the buying power of the general public but has also squeezed the jugular vein of industry.

2) It has certainly hurt a large section of the British public in its quest for the basic necessities of life. Those who borrowed large sums of money for a roof over their heads had calculated carefully before taking on a mortgage. They squeezed their ability to repay the mortgage and had squeezed their daily budget to meet repayments. Such people were already exercising restraint in unnecessary and imprudent expenditure. There was, in any case, little leeway to do so. This section of British society was certainly not responsible for inflationary trends. But, ironically, this is the section punished most severely by the so-called anti-inflationary measure of the government purportedly for the benefit of the general public. Meanwhile, the value of their houses has begun to nose-dive and they find themselves in an insoluble dilemma—unable to meet higher repayments and unable to find a buyer for their property.

3) Inflation is a complex phenomenon. It is not the purpose of this address to devote unnecessarily longer time to this subject, but for reasons, which will become apparent after a while, I have to beg the audience’s indulgence.

Among other things, the ball of inflation can be set rolling when excessive money in the hands of the buyer artificially raises demand while the supply of goods remains low. Too much money, for too few goods. There is more to buy and less to be bought. But, perhaps, in the case of the British economy, this situation did not prevail. The greater volume of money in circulation was supporting British industry to a large degree by increasing the consumption in the home market. Add to this the influence of tax cuts and moderate rates of exchange on the value of sterling in the international markets. This moderate exchange rate of sterling attracted overseas buyers to British manufactured goods to the advantage of British industry, which was already being generally helped by the expanding home market.

The most logical outcome should have been a drop in the prices of manufactured goods. A rise in production should have absorbed fixed overheads leaving only marginal costs to be borne by ex-factory prices of such goods. Even a bigger profit margin should have left the manufacturers with sufficient cushion to reduce prices.

The prolonged high interest rates have reversed this natural growth of the British economy with dire consequences for the future. Meanwhile, foreign markets, which slip out of their hands, will be difficult to regain.

4) The changes in Europe are transfusing more blood to the already robust economy of West Germany, or should one say Germany. The secondary negative effects enumerated earlier may augur ill for the British economy.

The present government may unsuccessfully manipulate the timing of the much needed drop in interest rates, but the next government, if it is Conservative, is going to inherit colossal problems from the erstwhile government of its own party.

The point which emerges from all this is a very important lesson for policy makers all over the world. Interest as a tool for controlling national economy meddles with the very concept of a free market economy. No economy run on the philosophy of interest-related capital can genuinely be declared to be free when its government has all the power to raise or lower interest rates.

The Islamic economic system provides no such measure of exploitation to the government.

Perhaps it will not be out of place to mention a few other aspects of interest. The inter-bank interest rate is only paid on wholesale deposits and not on savings account to the average depositor. Despite the compounding effect of interest, the return obtained on a small deposit is far below the true purchasing power of money. Although short-term rates fluctuate, in the long run, interest earned on deposits is below the inflation rate. On the other hand, a similar principal sum invested in some business venture has potential for growth in real terms.

In an interest-motivated society, owners of capital are always ready to lend money without investigating the ability of the borrower to repay. On the borrower side, there are few who seriously consider their repayment ability. Little do they know that borrowing from the loan-sharks, the likes of Shylock and prestigious finance houses and banks, is tantamount to borrowing from their own future earnings. It encourages the habit of living beyond one’s resources. It results in over-spending and an increasing inability to repay and honour one’s pledges. Such societies give an unrealistic boost to production to meet consumer demand.

This evil aspect of interest-run economies has to be further elaborated and illustrated.

In a society where keeping up with the Joneses becomes an obsession, the obsession is largely abetted by advertisements of the latest models of this and that. An introduction is provided to the general public of the luxurious lifestyle of the rich by displaying the latest design of sofas, luxurious chalets fitted with the most modern kitchen and bathroom appliances and gadgets.

People with less means available to buy all that they want are willy-nilly turned to false plastic money to fulfil their desires. Obviously, this means that they buy far more than their earnings. If this money was to be repaid even without interest, it would be tantamount to increasing one’s buying capacity at present at the cost of lowering the same in the future.

If a man earns $1,000 per month and goes shopping for expensive articles with the help of borrowed money, say, to the tune of $40,000, his ability to repay will be determined by his net savings per month. Let us suppose that he can barely make the ends meet at $600. This will leave him with net savings of $400 per month. He will have to live within that tight budget for the next 100 months to repay the loan arising from his spending spree of $40,000 without interest. What he has, therefore, done is to borrow money from his future 100 months (i.e., 8 years and 4 months) to spend at the beginning of this period. The only advantage he has gained is to satiate his impatience and fulfil his desire instead of waiting for the next eight years or so.

But if he has also to pay interest on his $40,000 borrowing, his financial position will be far worse than the one discussed in the previous example. At an average rate of, say, 14 per cent, his total loan from his own future earnings would work out to be far greater than the actual money he borrowed. This will lower his ability to repay and lengthen the period of repayment to a considerable degree. Such a person will have to suffer patiently for some 20 years or so as a punishment for his impatience making monthly repayments of about $500 i.e. a total of about $120,000 to repay the loan with compound interest.

The loss is most certainly of the borrower and not of the lender. The lender is part of a very powerful system of exploitation, which guarantees, after allowance for inflation and loan loss that the lender ends up with more money in his pocket.

With inflation, the situation of the borrower in question will further worsen. His buying power will continue to decrease so that if it was difficult to live within $600, it will be impossible to cope with the same as time goes by. There are but a few who are fortunate enough to receive annual increments equal to the rate of inflation.

To further aggravate the situation, in a society where people become more pleasure-seeking, it is impossible for them to wait for a long period of sheer austerity imposed on them by themselves after a few moments of reckless spending. More money is borrowed with greater recklessness and the expenditure is increased far beyond the means of income. In fact, decades of one’s future earnings with ever increasing debt-servicing and concomitant problems are pledged to the lending banks and financial institutions.

As a whole, such economies are inevitably heading for a major crisis. You cannot limitlessly pledge your future to the present before reaching the precipice of financial crisis arising from irresponsible spending which then raises the rate of inflation. To combat inflation by raising interest rates in the hope of making less money available for expenditure is bound to trigger a chain of events culminating in economic recession.

It is bad enough at the national level but when the same factors create a recession in most countries of the world, a global recession looms large on mankind. Such global recessions pave the path for global wars and gigantic catastrophes.

Bankruptcies and liquidations begin to increase. Trade and commerce enters into the doldrums. The underlying unemployment rate begins to creep up. Real estate businesses start to collapse. The resultant overall frustration in every area aids and abets homelessness, deprivation, fraud and crime. If this happens, it should not surprise anyone, least of all the stout champions of capitalism.

In the capitalist economy the situation is not limited to private individuals being financed beyond their means to repay. In fact, the future of the entire industry is jeopardised at the cost of temporary gains. To begin with, of course, the industry of the country benefits to a great degree. This helps in lowering the price of homemade goods. The transfer of money to an individual not only boosts his buying power but also has an impact on the productivity of the national industry. An increase in demand is followed by more production and with rising production, lower costs are achieved. It gives the national industry a competitive edge in international markets. All seems silvery and rosy. Then comes the hangover.

When, because of impatience and excessive spending beyond its means, the society as a whole is deeply indebted to the banks, the buying power of the entire society gradually comes to the end of its tether. Such industry has no alternative but to seek larger foreign markets to stay afloat and competitive. The smaller the country’s economic base the sooner it reaches the end of the blind alley. The larger the economic base, the longer will be the period of ultimate realisation of the impending crisis.

Let us turn to the USA to see how things may work there. Without doubt, it is a country with the largest home-market to support its industry, so much so that some economists believe that even if America is cut off from the international community, the broad base of the home-market would guarantee the survival of its industry. But such economists do not take account of other related factors. If you apply, for instance, the case discussed earlier to the America scenario, you will certainly begin to see that there can be no logical conclusion other than the one drawn earlier. It is only a question of time. With a huge budget deficit and trillions of dollars in outstanding debts, the USA as a whole has already overspent and the American public is under very heavy debt to its own future. The buying power of the nation as a whole is bound to slow down or lending houses will have to go bankrupt. It is only a question of size. But the inevitable laws of nature must operate and apply equally to all similar situations.

In a hot summer, pools and ponds warm up quickly to the ambient situation but it takes a bit longer for the lakes. Likewise, smaller seas get warmed up sooner than the larger ones. Yet, they all follow the same inevitable fate. It takes the Pacific Ocean so long to warm up that by the time it reaches that stage, winter is already set in most of the countries bordering on this gigantic mass of water. That is why the climate is more temperate than that of land bordering smaller oceans. Such also is the case of the oceans of the economy. The very philosophy of spending from borrowed money is basically so crooked that to expect straightforward honest results would be madness.

Another important factor should also be brought to the focus of one’s attention. When industry and the national economy reach choking point, poorer and less developed countries face ever-increasing danger of suffering from the fallout of the explosive situation of the developed and advanced countries.

It begins with greater urgency by political leaders of the industrialised countries to sell more goods in the markets to save industry from slowing down and to maintain the standard of living of its people. The problems they face are twofold:

1) The people are accustomed to modern comforts; and,

2) For the sake of its own survival, industry continues to excite them with new inventions and devices, which bring comfort and pleasure to their homes.

No political government can survive the pressure of a public, which continues to demand higher living standards. The economy must be kept afloat at whatever cost possible.

Obviously the Third World countries have to be bled more than before for the maintenance of artificially high standards of life in the advanced countries. What about the new challenge of the reshaping economies of the USSR and Eastern Europe and what about the growing need for foreign markets by the newly emerging capitalist states of the erstwhile communist world? Again, what about the havoc, which the Western media is already playing with the desires and ambitions of the poor and almost destitute common people of socialist and Third World countries? All these factors put together will certainly not change the face of the earth for the better.

This is the import of the warning so powerfully delivered to mankind 1400 years ago by the Holy Quran with regard to the holocaust to which the interest based economies would ultimately lead mankind.

Those who devour interest stand like one whom Satan has smitten with insanity. That is so because they keep saying: The business of buying and selling is also like lending money on interest: whereas Allah has made buying and selling lawful and has made the taking of interest unlawful. Remember, therefore, that he who desists because of the admonition that has come to him from the Lord, may retain what he has received in the past; and his affair is committed to Allah. But those who revert to the practice, they are the inmates of the Fire, therein shall they abide. Allah will wipe out interest and foster charity. And Allah loves not confirmed disbelievers and arch-sinners. Surely, those who believe and act righteously and observe Prayer and pay the Zakat, shall have their reward with their Lord. No fear shall come on them nor shall they grieve. O ye who believe! fear Allah and relinquish what remains of interest, if you are believers. But if you do not do it, then beware of war from Allah and His Messenger; and if you repent, then you shall have your original sums; thus you shall not wrong, nor shall you be wronged. And if any debtor be in straitened circumstances, then grant him respite till a time of ease. And that you remit charity shall be better for you, if only you knew.10

The warning about a war from God in the verses just cited means that the laws of nature governed by God would begin to punish the capitalist society when the factors which have been discussed earlier ultimately lead man to economic imbalance and warfare. Disorders, disturbances and wars always follow exploitation and usurpation of the rights of the poor. We warn you about a war with God and His Messenger means that the state, which thrives on interest, would inevitably end up in a situation where the nations will rise in arms against each other.

Time does not permit me to elaborate this aspect of interest. In the Holy Quran, verses prohibiting interest always follow verses on warfare. This indicates the inter-relation of interest and war. Those who are familiar with the history of the First and Second World Wars would remember that capitalism played a disastrous role in not only causing but also prolonging those wars.

Islam rejects every form of exploitation and unfair means like the hoarding of wealth, capital, commodities and supplies, which set in motion spiralling prices and end in general inflation. The Holy Quran states:

O ye who believe! Surely, many of the priests and monks devour the wealth of men by false means and turn men away from the way of Allah. And those who hoard up gold and silver and spend it not in the way of Allah—give to them the tidings of a painful punishment. On the day when it shall be made hot in the fire of Hell, and their foreheads and their sides and their backs shall be branded therewith and it shall be said to them: ‘This is what you treasured up for yourselves; so now taste what you used to treasure up.’11

Yet Islam grants freedom to individuals to earn money by any lawful means within the Islamic code of economic behaviour. Thus there is the freedom and right for individuals to possess property and enter into private enterprise.

In shaping the economies of their countries, the focus of attention of most governments is on how a member of society earns his livelihood. Taxation is imposed on sales turnover, profit from trade and commerce and earnings from employment. Having done that, there is little further interference in the financial affairs of the individual. Broadly speaking, national interest is limited to the income side but what or how an individual spends his earned or hoarded income is no concern of most states. If he so pleases, an individual may flush his income or wealth down the drain. He may acquire a lavish and extravagant lifestyle or, despite his wealth, he may live in hardship if he chooses. It is no business of the state to interfere with how he intends to spend or employ his money.

Nevertheless, this is an area where religions do step in and, by way of admonishment or counsel, not only tell an individual how he should earn his daily bread but also guide him as to how he should or should not spend what he has earned. Most injunctions relating to expenditure are primarily moral and spiritual guidelines. For instance, when Islam prohibits expenditure on drinking and gambling and over-indulgence in various pursuits of pleasure, though such injunctions may not directly aim at shaping the expenditure budget, they are a by-product of the moral and spiritual teachings of a religion. In capitalist economies, such injunctions are considered as an invasion of privacy and an interference with the right of an individual to spend as he or she pleases. But this attitude is not new to man.

According to the Holy Quran, earlier people and civilizations displayed exactly the same attitude towards religions, which sometimes resulted in a debate as to the justification of religions to interfere with people’s personal affairs. When Shu‘aib(as), an ancient Prophet, attempted to educate the people of Midian on how best they should spend their wealth and what they should refrain from, he was rebuked by his people:

They replied, ‘O Shu‘aib(as), does thy Prayer bid that we should leave what our fathers worshipped, or that we cease to do whatever we may please with our wealth? Thou art indeed very intelligent and right-minded’.12

Islam advocates a simple lifestyle. It prohibits extravagance and encourages expenditure:

Keep not thy hand chained to thy neck, nor stretch it out an entire stretching, lest thou sit down blamed or exhausted.13

Give thou to the kinsman his due, and to the poor and the wayfarer, and squander not thy wealth extravagantly. Verily, the extravagant are brothers of Satan, and Satan is ungrateful to his Lord.14

The style of marriage ceremonies between the rich and poor families can be a sensitive area which may cause terrible anguish and heartache to the poor parents with daughters of marriageable age.

Lavish wedding receptions with a grand display of pomp, opulence and pageantry are roundly condemned in Islam. In fact, we observe from the early history of Islam that wedding ceremonies were so simple as to appear colourless events in the sight of many. Although influenced by the customs and tradition of the surrounding societies, many innovations and malpractices have crept into Muslim marriage styles of the rich, and basic formal ceremony remains exactly the same–plain, simple and inexpensive for the rich and poor alike.

The announcement of marriage i.e. Nikah is pronounced mostly in mosques in the presence of all and sundry and where the rich and poor are gathered alike. The mosque is a house of worship and is no place for pompous display.

As far as the reception feasts and other related expressions of joy are concerned, the rich are very firmly warned that any feast to which the poor have not been invited is cursed in the sight of God. Thus, amongst the most well dressed richest members of society, you will find the most poorly dressed poor people mixing freely with the rich—a grand eye opener for the rich and a special opportunity for the poor to taste some of the delicacies, fruits and dishes of the wealthy people.

The rich and the more highly placed people in the social order are strongly advised to accept the invitation of the poorest should such a person invite them to his humble home. Of course, it is not a must for the rich who may have their own prior commitments and difficulties, but it was a constant practice of the Holy Founder(sa) of Islam to accept the invitation from even the very poorest. All those who love him as their holy Master are very proudly influenced by this admonition. Although in contemporary society, to always accept all such invitations would place the rich with no other preoccupation, but to eat with the poor, the spirit of this injunction can still be kept alive by occasionally accepting such invitations.

We have already stated that wine and gambling is prohibited. Lavish expenditure on revelry is therefore obviated. This general admonition condemning lavish expenditure and a high flying lifestyle applies not only to marriages, but all spheres of human activity. The beauty of this teaching is that it is not enforced by compulsion but is prompted by words of advice and love.

O children of Adam! look to your adornment at every time and place of worship, and eat and drink but exceed not the bounds; surely, He does not love those who exceed the bounds.15

Time does not permit me to dwell on the need to wage a war against hunger to which end the prevention of food wastage is an important stepping-stone. Nonetheless, I shall briefly refer to this subject later.

As far as borrowing money for the basic necessities of life is concerned, Islam strongly and repeatedly propounds that loans for exigencies and emergencies be without interest. Those with means should help those who need financial assistance. It is also clearly laid down that if the debtor is unable to return the loan in due time because of his straitened circumstances, he must be granted a greater period of grace. Close relatives may assist a debtor. Debts can be recovered from a deceased person’s estate. Zakat can also be used to alleviate the financial obligations of one burdened with debt. If the rich can write the loan off, it would be better still in the sight of God. Nevertheless, a debtor who can afford to return the loan must fulfil his promise in repaying the loan within its appointed term and should add an ex-gratia amount thereon. This is not, however, obligatory nor predetermined since it would then fall under the broad definition of interest. The Holy Quran teaches:

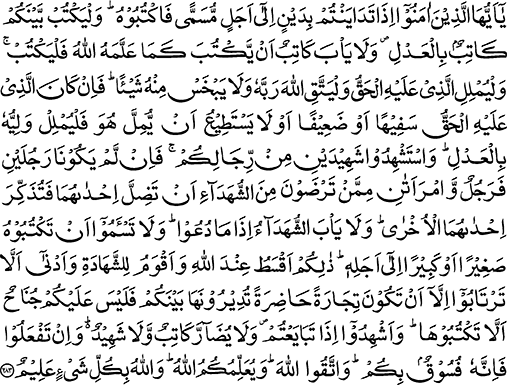

O ye who believe, when you take a loan, one from another, for a term, reduce the transaction to writing; and let a scribe record it in your presence faithfully. And no scribe should refuse to set it down in writing, because Allah has taught him, so he should write. And let him who undertakes the liability dictate; and he should fear Allah, his Lord, and not diminish anything therefrom. But if the person incurring the liability should be of defective intelligence, or a minor, or unable to dictate then let his guardian dictate faithfully. And procure two witnesses from among your men; and if two men be not available, then one man and two women, of such as you like as witnesses, so that if either of the two women should be in danger of forgetting, the other may refresh her memory. And the witnesses should not refuse to testify when they are called upon to do so. Whether the transaction be large or small, do not be disinclined to write it down, together with the appointed time of payment. This is more equitable in the sight of Allah, makes testimony surer and is more likely to exclude doubts. In case of ready transactions when goods and money pass from hand to hand, it shall be no sin for you not to reduce them to writing. And have witnesses when you buy or sell. And let no harm befall a scribe or a witness and if you do such a thing it shall certainly be disobedience on your part. And be ever mindful of your duty to Allah. And Allah grants you knowledge and Allah knows all things well. And should you be on a journey and not find a scribe, the alternative is a pledge with possession. And when one of you entrusts something to another, then let him who is entrusted render back his trust when he is called upon to do so, and let him be mindful of his duty to Allah, his Lord. And conceal not testimony; and whoever conceals it is one whose heart is certainly sinful. Remember Allah knows well all that you do.16

It is very important to remember that these verses have been completely misapplied and used entirely out of context by those medieval minded scholars who insist that according to Islam a single woman’s testimony is not sufficient. They say that for each legal requirement, two women’s testimony is essential in comparison to one man’s wherever one man’s testimony is sufficient. Having totally misconstrued the meaning of these verses, they have falsely envisaged the role of male and female witnesses in Islamic jurisprudence. They think that when the Holy Quran requires one man as a witness, the testimony of two women will be substituted in lieu thereof; where two men’s testimony is required, four women’s testimony will be required; and where four male persons are required as witnesses, eight women will be required to testify the same.

This concept is so unrealistic and alien to Quranic teachings that one is exasperated to see such medievalist stance on this important judicial issue.

The following points should be noted regarding these verses:

The role of the second woman is clearly specified and confined to be that of an assistant.

If the second woman who is not testifying finds any part of the statement of the witness as indicative of the witness not having fully understood the spirit of the bargain, she may remind her and assist the witness in revising her understanding or refreshing her memory.

It is entirely up to that woman who is testifying to agree or disagree with her assistant. Her testimony remains as a single independent testimony and in case she does not agree with her partner, her’s would be the last word.

After this brief digression, let us return to the subject proper.

Reducing loan agreements to writing with the debtor dictating the terms in the presence of witnesses for the sale of goods; being absolutely honest and mindful of God in fulfilling one’s undertakings; and trustees discharging the trust honestly form the essential features of contractual obligations in Islam.

It should be noted that in an economy where lending tends to be interest free, the lender will not unnecessarily flush the economy with loans and credit. Therefore, the buying power of society will remain within realistic limits and related to the present. The tendency to borrow from the future will automatically be averted. An industry founded on this platform is bound to remain solid and able to survive the vicissitudes of economic hazards.

Public wealth should not circulate in the higher plane of the wealthy but should flow in the direction of the lower plane of the poor.

Islam cultivates a lifestyle, which is simple and, though strictly speaking not austere, is in no way glamorous and profligate to the extent that it begins to offend the poorer sections, causes heartache and widens the distance between the two sections of society.

It should be well understood here that classes are created not merely by the accumulation of wealth in fewer hands but by the division of capital among owners and the labourers or by landlords and those who cultivate the land.

There is much more to the creation of a class society. It is impossible to mention all the factors and how they jointly and severally contribute towards the creation of classes.

A study of traditional Indian society should provide an excellent example of the existence of a class structure evolved over thousands of years. The entire course of this evolution was influenced not by the distribution of wealth but by racial, social, religious and political factors. A long history of invasions, internal strife, struggle for survival and domination is preserved in the caste system of India, which has carved so many classes.

Marx took serious note of this situation. In a series of letters to New York’s Herald Tribune, he considered the state of society in India as being at variance with the philosophy of scientific socialism. He concluded that the existence of this caste system rendered India the least likely country to turn to communism.

From the Islamic point of view, the creation of classes in a society begins to hurt only when there is no code of ethics governing the way money should be spent. Imagine a society where people live a simple life, with no lavish expenditure on their clothing, food or accommodation and where the contrasts in the style of life are not so distinctly marked. No matter how much wealth may have accumulated in a few hands, it is the expenditure, which hurts rather than the accumulation of wealth in a few hands. It only begins to hurt when it is unevenly or imprudently spent or wasted. It is the luxurious lifestyle of the rich and all its concomitant flair, display, pomp and pageantry, which, when observed from the lowly vantage point of the miserable and suffering poor struggling for survival, the uneven distribution of wealth begins to create unbridgeable chasms between the two.

Therefore, Islam does not unduly interfere with the freedom of an individual to earn and to keep. On the contrary, it promotes and encourages the private sector more than the public sector. It lays down a well-defined code concerning the style of life which when followed to the letter and spirit, would make life as a whole refreshingly simple for all.

As this aspect of Islamic economic philosophy has been discussed earlier, we need not dwell upon it further.

The Islamic law of inheritance also plays an important role in the distribution of wealth from the deceased to his dependents. Prescribed shares must be distributed amongst parents, spouses, children, relatives and kith and kin. One cannot deprive them of their rights of inheritance granted to them by God unless there be a good reason, the validity of which will be determined by the courts in an Islamic state and not the individual. At best, a person can bequeath a maximum of one third of his disposable possessions to other people or societies of his choice.17 These measures effectively prevent the accumulation of wealth in fewer hands.

Under the Islamic law of inheritance, the rule of primogeniture or those which involve the impartiality of estates or the unrestricted power of bequest at the whimsical pleasure of the testator are prevented. Both movable and immovable property continues to be divided and sub-divided in each generation and within three or four generations, even large estates are parcelled out into small holdings so that no permanent division is created among the people by a monopoly of the ownership of the land.

Do not devour your wealth among yourselves through falsehood, and offer it not as a bribe to the authorities that you may knowingly devour a part of the wealth of other people with injustice.18

Again I have to omit this aspect, which is particularly noticeable in the form of corruption and bribery in the Third World countries but shall refer to it under individual peace.

Islam neither disagrees with capitalism nor totally rejects scientific socialism but retains their good points and attitudes.

Following are some examples where 1400 years ago, Islam advised a code of sound commercial ethics which modern man has ultimately discovered the hard way:

Islamic commercial relations are based upon absolute trust and honesty.19

Islam forbids the use of false weights and the giving of short measure.20

Traders are forbidden from selling defective articles or goods which are rotten or rendered useless. A trader must not try to conceal any defects of an article which he offers for sale.21 If such an article is sold without the buyer’s prior knowledge, he has a right to return it when he discovers the fault or defect and obtain a refund.22

A trader is prohibited from charging different rates to different customers though he has discretion to offer concessional discounts to any customer(s). He is free to fix any rate he considers reasonable.23

Islam forbids false competition or cartels, which create false competition. It also forbids the inflating of prices at an auction by false bids or procuring bogus offers to deceive a prospective buyer.24

Likewise, Islam recommends that the purchase and sale of goods take place in the open preferably in the presence of witnesses and that the buyer be put on alert on what he purchases.25

To cut a long story short, Islam adopts the strategy of decreasing the gap between the rich and poor by:

Imposing certain inhibitions as have already been mentioned before e.g. drinking, gambling, etc.

Prohibiting the hoarding of wealth and its accumulation by interest.

Encouraging private enterprise.

The use of repeated admonition, persuasion and instruction appealing to the nobility in man to voluntarily adopt a humble, meek and simple lifestyle which is not too far removed from the reach of a poor man.

The object of this exercise is to make man more sensitive to the feeling of others and to choke and kill in him the bestial and sadistic impulses. A holy war in the real sense of the words is waged against vanity, hypocrisy, superficiality, snobbishness, pride and arrogance. All that is refined and noble in man is brought out and he is made so sensitive to the sufferings of others that he sometimes feels it to be a crime to live in luxury and comfort while others suffer and eke out an existence of misery and wretchedness.

Of course, such highly cultured people who form the vanguard of sublime human values are always in a small minority but the overall consciousness in society for the well-being of others is raised to such a respectable level that it becomes impossible for them to remain concerned only with their own necessities and comforts, oblivious of the miserable state of the less fortunate section of society. Their concern in life no longer remains introvert. They learn to live with a wider consciousness of life around them. They feel uneasy unless they materially participate in ameliorating the sufferings and raising the standards of life of others.

The characteristics of such society of believers is described in one of the earliest verses in the Holy Quran and cited previously in this address:

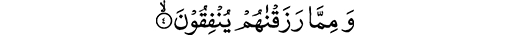

And spend out of what We have provided for them.26

In the previous section on socio-economic peace, we have seen how Islam has revolutionised the concept of alms for the poor and needy. As far as the rights of individuals in the national cake are concerned, the Holy Quran gives us the criteria whereby we can determine how much wealth, which should have flowed to the common man, has been transferred into the hands of a few capitalists:

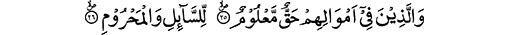

Those in whose wealth there is a recognised right for one who asks for help and for one who does not.27

These verses address the rich and remind them that part of their wealth comprises that which by right belongs to the beggar and the destitute.

How can we judge that an imbalance has arisen in society by the transfer of rights due to the poor into the hands of a few rich people? The yardstick for this criterion is certain guaranteed rights.

According to Islam, there are four basic needs of man, which must be fulfilled. The Holy Quran states:

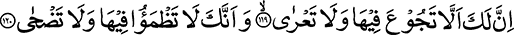

It is provided for thee that thou wilt not hunger therein, nor wilt thou be naked. And that thou wilt not thirst therein, nor wilt thou be exposed to the sun.28

Thus, Islam establishes minimum rights in the form of a four-point charter by defining the basic needs, which a state should procure:

Even in England and the United States of America, there are hundreds of thousands of people without shelter and those who have to dip into dustbins to find some scrap of food to satiate their hunger.

Such ugly scenes expose the inherent weakness of the capitalist society and bring to the surface the symptoms of a deep underlying malaise. Materialism in its ultimate form breeds selfishness and callousness and dulls human sensibilities to the sufferings of others.

Of course there are even uglier scenes of misery caused by extreme poverty in most Third World countries, but the society as a whole is poor and the countries themselves are run on the same capitalist principles. Hence, it is not a question of whether the majority population of such countries is Christian, Jewish, Hindu, Muslim or pagan—the system essentially remains capitalist in nature.

Crime flourishes and vice prospers in the ghettos, which are a blemish on the face of humanity itself in the so-called developed nations of the world.

There are regions in Africa and in other countries where even potable water is not available to large sections of society. If you even get one square meal a day, you consider yourself lucky. Water becomes an every day problem. There are countries in the world, which have all the potential and resources to change their lot within a matter of a few years without feeling the pinch themselves. Yet such countries do not care to commit their resources to ameliorate the sufferings of the hundreds of millions of people in poorer countries.

From the Islamic point of view, this question is very important. According to Islam, it is not just the sufferings of one man for which the society of that country is responsible but it is the sufferings of any human being in any society, that is to say, humanity which has neither geographical boundaries, nor colour, creed or political demarcations. Humanity at large is responsible and human beings as such are answerable to God. Whenever famine, malnutrition or sufferings from any other natural disaster strikes any community, it must be treated as a human problem. All societies and states of the world must participate to help mitigate the sufferings.

It is a shame that despite all the advancement in science and technology, the elimination of thirst and hunger has not received the attention it needs. There must be a system whereby the sum total of human wealth can be quickly and efficiently channelled to those areas where hunger strikes or famine plays havoc with humanity or wherever people have been rendered destitute and homeless.

Governments have both national and international responsibilities. These responsibilities on the national level are to fulfil the basic needs of each member of society by ensuring that all are fed adequately, clothed, and provided with water and shelter. The international duty, to which further reference will be made later, is to fully participate in pooling resources to meet the challenges of wide scale natural disasters or man-made calamities and to help such countries as are by themselves incapable of appropriately handling the crisis.

As such, it is the duty of the state to set the matters aright by transferring back to the beggars and poor people what truly belongs to them. So the four fundamental requirements of food, clothing, water, and shelter, will have preference over all other considerations.

In other words, in a truly Islamic state there can neither be a beggar nor a destitute without food, clothing, water and shelter.

These overall requirements being guaranteed, the minimum responsibility of the state is discharged. But the society as a whole is supposed to do much more than this.

Man cannot live by bread alone is a profound maxim. Add to this the requirement of healthy water, appropriate clothing and a roof over his head. Yet, all these requirements put together cannot make life complete. Man will always be in search of something more than the bare necessities of life. So there has to be something else to be done by the society to remove the drabness, add some colour to the life of the poor and to make them share some of the pleasures of the wealthy.

Again, it is not enough that the more fortunate members of society should share their wealth with the less fortunate members of society. But it is also necessary that they share the miseries that go with poverty, which afflicts a very large number of human beings. There has to be some system of the intermixing of the rich and the poor whereby, of their own volition, the upper layers of society mix with the people at lower levels to personally witness what it really means to live in poverty. Islam proposes many measures, which make it impossible for the various classes to be compartmentalised and insulated in their own spheres. We have briefly mentioned some of these measures earlier.

1) Commencing with the affirmation of there being no god other than the One God, establishes the unity of God and His creation thereby uniting mankind under the Almighty Creator.

2) The five daily Prayers which are to be said in congregation is perhaps one of the most effective of all the measures in this regard. The rich and the poor and the small and the big, are required, without exception, to say their Prayers in mosques, if accessible. If not all, at least a large section of Muslim society is responsible for abiding by this injunction. The percentage of those who regularly pray five times a day may be lower in some countries and higher in others, but it is a common experience shared to a greater or lesser degree by a majority of Muslims.

The system of Prayer in itself is a grand message of the equality of man. The one who reaches the mosque first occupies the place of his choice and none, howsoever highly placed in society he may be, can ever think of displacing him. At the time of Prayer, all stand together—shoulder-to-shoulder—with no gap in between. The most impeccably dressed may have standing adjacent to him someone clad in tattered rags. The weak and pale and the healthy and robust all meet together daily on an equal platform where the message invariably repeated is: God is the Greatest.

To see eye-to-eye the misery in which some members of a locality are living and to meet them daily, leaves a very powerful effect on the heart of a man living in comparative comfort. The message is loud and clear that you must do something to ameliorate their sufferings and lift their standards or be degraded yourself in the estimation of God as well as your own estimations.

The area of this contact is broadened further on each Friday where Muslims gather at a central mosque so that people from richer neighbourhoods meet those from poorer areas. It is extended still further on each of the bi-annual festivals, which are preceded by Fitrana, a fund raised by voluntary contributions for the relief of the poor.

3) The Muslim month of fasting also sets on an equal plane the rich and poor. The rich endure thirst and hunger to remind themselves of the lot of the poor for whom thirst and hunger is but a way of life.

4) Zakat transfers the due right of the poor from the capital of the wealthy.

5) Then, finally, the fifth pillar of Islam is pilgrimage, often described as the greatest spectacle of human unity. The female pilgrims are permitted to wear simple sewn clothes. The male pilgrims are clad in two unsewn sheets—a uniform for both the rich and the poor.

But that is not all. Apart from the above acts of worship, there are many other measures introduced and implemented in a Muslim society which continuously bridge the gap between various sections of society and provide the much needed ventilation and convection for a healthy environment in which the rich are allowed to remain reasonably rich but are also required to care for the poor.

A similar principle was expounded by Jesus(as), when he said, the meek shall inherit the earth. It is a great pity that despite this moral injunction, capitalism has singularly failed to care for the poor and the meek members of society.

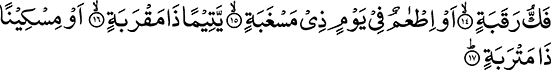

Discussing the alternative course of action to be adopted during periods of any natural disaster or great calamity afflicting any society, (see basic needs mentioned earlier) the Holy Quran describes the right choice in the following sequence:

It is the freeing of a slave; or feeding on a day of hunger an orphan, near of kin; or a poor man lying in the dust.29

In other words, the right choices are:

The genuine and true service of mankind, which is acceptable to God, has been described here. The foremost of those that need any help is that man should help those who are under any bondage or ties. Any service contrary to this concept is regarded by God as worthless. In the light of this, the modern system of providing financial aid to less developed countries with preconditions and strings attached to the aid is totally rejected.

The next choice is the feeding of an orphan even if he or she has a guardian to support him or her.

The final choice is the feeding of a destitute who is so helpless as though he had bitten the dust.

Although addressed in the singular, these verses are evidently describing a wide scale crisis. The connotation of the word yaum (lit. day) and the general style of expression is so obvious. Upon reflection, the implications of this verse paint a very clear picture of how big, wealthy and powerful nations treat the poorer ones who stand in dire need at times of extreme helplessness. They are provided with aid but with strings attached. Thus the very purpose and spirit of helping others is destroyed. They are liberated apparently from one misery only to be led into the snare of another.

The entire contemporary system of international aid with strings attached is crisply described here in such few words. The believers are told not to take undue advantage of helpless people by relieving the sufferings of poor individuals or nations and at the same time depriving them of their liberty.

The word ‘orphan’ is used in a wider sense as it applies to dependent individuals as well as nations. Such nations, who like orphans with wealthy relations have been abandoned by their kith and kin, should not be left unaided because they might be helped by others who are primarily responsible for them.

The case of the oil rich states is a fit example. If only a few states of the Gulf had joined hands to relieve immense sufferings of humanity at large, they could have resolved the problem of hunger and drought in Africa without feeling a pinch. The mountains of money they have in bank deposits and foreign assets in Western countries generates interest and income which alone is sufficient to allay the misery and suffering to Africa. In any case, Islam forbids them from spending such interest for their own use.

The case of a multitudinous sea of hunger, misery and want from the numerous calamities in Bangladesh is another deserving case to be studied in this context. They have been abandoned by the rest of the world to their own lot. The aid, if any, which trickles down to them, is virtually ineffective for relieving their misery.

Such nations must be considered ‘orphan’ nations according to the wider definition of the term. When such orphan nations are abandoned by their own kith and kin, this constitutes a serious crime in the sight of God.

People have a very naive and even crooked attitude towards God and nature for the sufferings of the poorer nations whilst, most certainly, it is man himself who is to be blamed for his utter callousness and disregard. If we fill the hearts of human beings with that special quality and are able to suffer for the sake of others, the world can still be turned into a paradise.

In the world outside Islam, the same selfish attitude prevails. If Ethiopia, for instance, happens to have close ties with the Soviet Union, aid should not be withheld on the pretext that it is for the Soviet Union to discharge its responsibility as a patron. If millions of Muslims in Sudan are dying of hunger, their plight should not be ignored on the plea that wealthy nations like Saudi Arabia and other oil-rich Muslims states, being virtually their kith and kin, have the ultimate responsibility to feed them. This is the true import of the Arabic expression yatiman dha maqrabatin (lit. an orphan, near of kin).

Again, it is pointed out in this verse that individuals or nations, who suffer through individual or national economic crises, must be helped to make them stand on their own feet. This scenario applies to many Third World countries whose economy is rapidly crumbling because timely, wide scale help is not provided.

The third choice is au miskinan dha matrabatin, which applies to such economies, as are reduced to dust and the entire economic system of the nation has collapsed. According to the Holy Quran, feeding the people in such countries is not enough. It is the responsibility of man to adopt measures to restore and rehabilitate their economies.

Unfortunately, trade relations in this contemporary age represent the exact opposite. The flow of wealth is always in the direction of the richer and more advanced countries while the economies of poorer countries sink deeper in the red.

I am not an economist, but understand this much at least that it is impossible for the Third World countries to retain bilateral trade relations with the advanced countries and yet prevent the flow of wealth from their countries to those of the rich by ensuring that export revenues equal the import bill.

Another important factor to bear in mind is that in all economically advanced nations, there is a constant urge for an improvement in living standards. The poorer nations are encouraged to borrow money to match the rising living standards of the developed world. Push-button technology leads to an easier and more comfortable life, even if such addictions to modern amenities, ultimately, may adversely influence the human character of hardiness. But if the people in advanced countries want to restore blood to their own cheeks and restore their own physical health, how can the wealthier nations be expected to relieve the poorer nations from a state of pernicious, terminal anaemia when their own thirst for more blood knows no bound and when their standard of living must continue to rise, and all that money can buy must constantly be transferred into their own economies?

This mad race for rising living standards without discrimination is not only robbing the poorer nations of their chance of survival but is also robbing the advanced nations themselves of their peace of mind and contentment of heart. The whole society is tantalised in the pursuit of artificially created needs so that everyone lives in a constant state of wanting something to keep up with the Joneses. This again is a state of affairs, which can potentially lead to war.

This tendency is strongly discouraged in Islam. Islam presents to you a picture of a society in which people live within their means and there is some saving for a rainy day, not only at an individual and family level, but also on a national basis.

For poorer countries, such a situation is potent with dangers because when the advanced countries suffer from the new challenges of competition from emerging economies, and their own economies begin to stagnate, they would become more callous in their relationship with the Third World or poorer countries. This is inevitable because, somehow or the other, the governments of richer countries must maintain a reasonable standard of life for the people who have become addicted to them.

Ultimately these situations aggravate and culminate in factors, which create wars. It is such wars that Islam seeks to prevent.

1 Ch. 89: Al-Fajr: 18–21

2 Ch. 102: Al-Takathur: 2–4

3 Ch. 3: Al-‘Imran: 190

4 Ch. 4: Al-Nisa’: 54

5 Ch. 16: Al-Nahl: 72

6 Ch. 4: Al-Nisa’: 59

7 Ch. 64: Al-Taghabun: 16

8 Ch. 24: Al-Nur: 57

9 Ch. 9: Al-Taubah: 60

10 Ch. 2: Al-Baqarah: 276–281

11 Ch. 9: Al-Taubah: 34–35

12 Ch. 11: Hud: 88

13 Ch. 17: Bani Isra’il: 30

14 Ch. 17: Bani Isra’il: 27–28

15 Ch. 7: Al-A’raf: 32

16 Ch. 2: Al-Baqarah: 283–284

17 Ch. 4: Al-Nisa’: 8–13

18 Ch. 2: Al-Baqarah: 189

19 Ch. 2: Al-Baqarah: 283–284

20 Ch. 83: Al-Tatfif: 2–4

21 Muslim

22 Hadith

23 Bukhari and Muslim

24 Bukhari and Muslim

25 Ch. 2: Al-Baqarah: 283–284; Muslim

26 Ch. 2: Al-Baqarah: 4

27 Ch. 70: Al-Ma‘arij: 25–26

28 Ch. 20: Ta-Ha: 119–120

29 Ch. 90: Al-Balad: 14–17